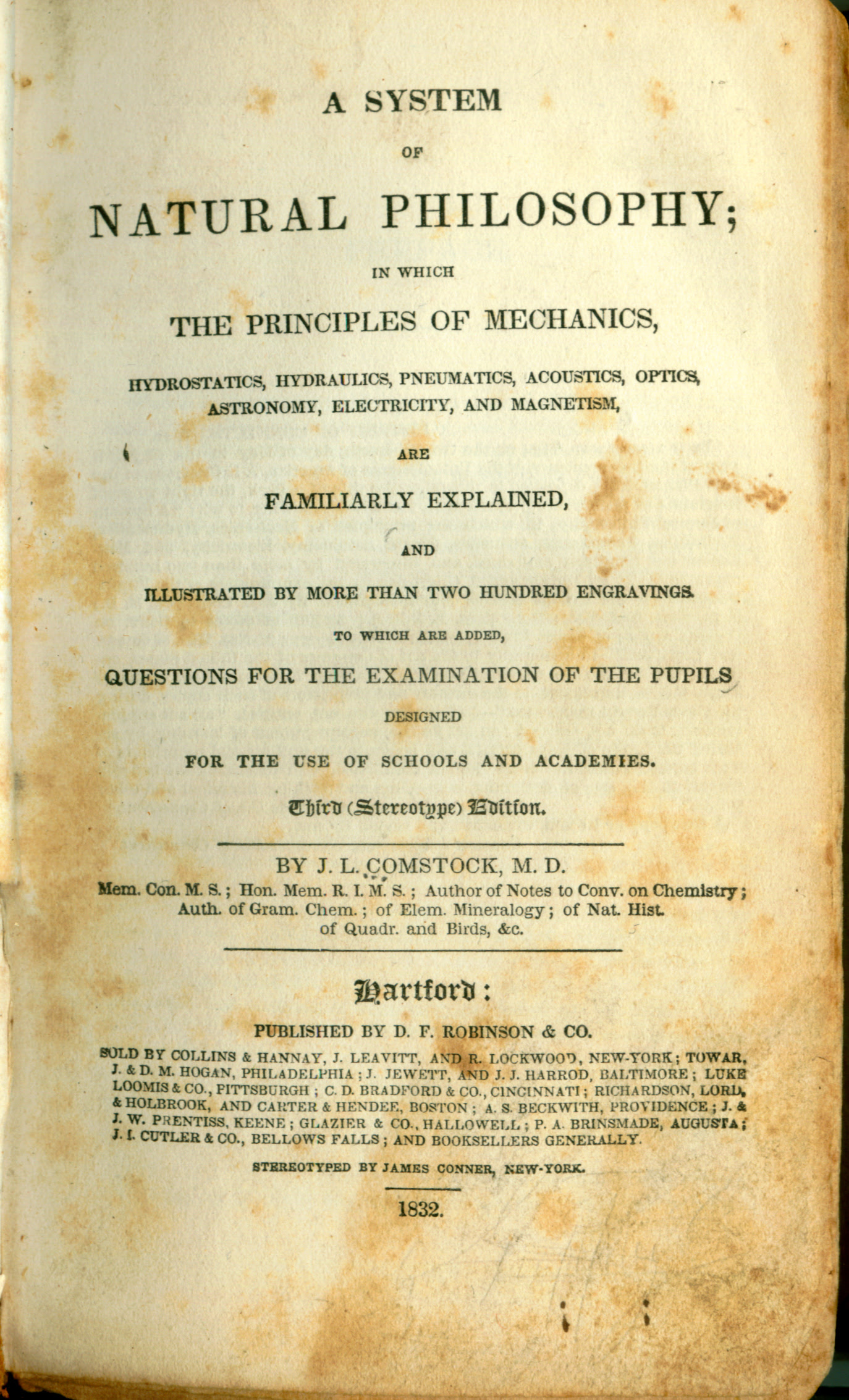

Investment Science by David G. Luenberger

Fueled in part by some extraordinary theoretical developments in finance, an explosive growth of information and computing technology, and the global expansion of investment activity, investment theory currently commands a high level of intellectual attention. Recent developments in the field are being infused into university classrooms, financial service organizations, business ventures, and into the awareness of many individual investors. Modern investment theory using the language of mathematics is now an essential aspect of academic and practitioner training. Representing a breakthrough in the organization of finance topics, Investment Science will be an indispensable tool in teaching modern investment theory. It presents sound fundamentals and shows how real problems can be solved with modern, yet simple, methods. David Luenberger gives thorough yet highly accessible mathematical coverage of standard and recent topics of introductory investments: fixed-income securities, modern portfolio theory and capital asset pricing theory, derivatives (futures, options, and swaps), and innovations in optimal portfolio growth and valuation of multiperiod risky investments. Throughout the book, he uses mathematics to present essential ideas of investments and their applications in business practice. The creative use of binomial lattices to formulate and solve a wide variety of important finance problems is a special feature of the book. In moving from fixed-income securities to derivatives, Luenberger increases naturally the level of mathematical sophistication, but never goes beyond algebra, elementary statistics/probability, and calculus. He includes appendices on probability and calculus at the end of the book for student reference. Creative examples and end-of-chapter exercises are also included to provide additional applications of principles given in the text. Ideal for investment or investment management courses in finance, engineering economics, operations research, and management science departments, Investment Science has been successfully class-tested at Boston University, Stanford University, and the University of Strathclyde, Scotland, and used in several firms where knowledge of investment principles is essential. Executives, managers, financial analysts, and project engineers responsible for evaluation and structuring of investments will also find the book beneficial. The methods described are useful in almost every field, including high-technology, utilities, financial service organizations, and manufacturing companies. Editorial Reviews Review A great book. Professor Luenberger has created a masterpiece that can serve as both an excellent introduction for novices and as a rich source of examples and well explained fundamental principles for more advanced readers.?Milan Lukic, University of Wisconsin-Oshkosh Outstanding book. Very intuitive development of a reasonably mathematical subject. Log-optimal integrated into main budget theory. Excellent.?Edwin T. Burton, University of Virginia An excellent text. It is unique in being as precise as a mathematically oriented reader could wish re: financial jargon.?Viswanath Ramakrishna, University of Texas at Dallas Advance Praise Options and continuous-time finance are important enough to warrant a whole course in MBA programs. David Luenberger's book makes continuous time finance accessible to any student who has mastered elementary calculus and probability theory, and motivates the subject by using it to solve a broad range of option-type problems relating to stock, bond, and commodity markets. ? Jack Treynor, President, Treynor Capital Management, Inc. This textbook takes a refreshing approach to the science of investing. It is extremely well-written. Financial principles and ideas are laid out clearly and in an orderly fashion. The proofs to theorems are elegant yet intuitive. ? Joseph Cherian, Department of Finance, School of Management, Boston University Investment Science is a wonderful textbook treatment of investment theory for the quantitatively-minded undergraduate or masters student. This book is typical of David Luenberger's uncanny way of simplifying complex technical material without loss of rigor. He divides and conquers the subject, starting with the basics of simple fixed-income securities, and building up to the valuation and hedging of derivative securities in a dynamic setting under uncertainty. There is a lovely interplay of arbitrage calculations, portfolio selection for individual investors, and market equilibrium. The book will be especially valuable for those entering the subject from other quantitative fields.?Darrell Duffie, Stanford University Graduate School of Business The book is very clearly written and introduces advanced concepts (e.g. duration and convexity of bonds) in relatively simple and intuitive ways early in the book. There are lots of carefully thought out examples to illustrate important points and applications of particular methodologies. Overall, the book does a great job of taking a reader who knows essentially nothing about finance from very basic concepts up through rather advanced valuation topics. ? James E. Hodder, University of Wisconsin-Madison This text is a breakthrough in the organization of very important theory. ?Lloyd Nirenberg, Director, Business Development, National Semiconductor Corp. This book provides great insights and practical approaches for anyone interested in the relation between markets and decisions. It is written in a unique and creative manner. ?Nick V. Arvanitidis, CEO,IDEA GmbH., and Former CEO, Sequus Pharmaceuticals Luenberger's book is very informative and offers genuinely new insights into important investment problems.?Paul McEntire, Chairman, Skye Investment Advisors LLC Professor Luenberger's book, particularly Chapters 15 &16, lays the foundation for the analytic approach Enron takes when assessing and managing risk in its non-traded asset portfolio.?Andrea Vail, Vice President, Enron Capital Management Professor Luenberger's book provides a well written and readable introduction to several important areas in financial engineering. The sections on derivatives are very useful. This book will be great for quantitatively oriented MBAs. Another important audience is those students with advanced quantitative training, but little formal economics or prior finance.?Dr. Aram G. Sogomonian, Corporate Vice President, Risk Management, Edison Source This book is well written, clear, and cohesive. There is not a single investment textbook that I am aware of that gives such in-depth and organized treatment of the topics chosen by this book. A distinguishing feature is that it gives you every single detail and tool that you would ever need to solve problems.?Raymond Kan, University of Toronto This is a well-organized, fun text. The examples are plentiful and carefully positioned in the text to illustrate the theory.? Phillip Daves, University of Tennessee This book goes into detail on several interesting advanced topics. Its no nonsense writing style and appropriate use of math are also admirable.?Duane Seppi, Carnegie Mellon University The book's main strengths are its quality of exposition, careful derivations of technical aspects, and extensive exercises at the end of each chapter.? Costis Skiadas, Northwestern University This is the best single volume on investments ever written. It is one of the only books to cover both derivatives and portfolio optimization, and it does not get bogged down with unnecessary notation. It is a real page turner. For non finance types looking for a serious, rigorous introduction to the subject, look no further.?Wayne Winston, Professor of Decision Sciences, Indiana University About the Author David G. Luenberger, Professor in Engineering-Economics Systems & Operations Research, Stanford University. He has written several successful books with Addison-Wesley and John Wiley publishers.

Publication Details

Title:

Author(s):

Illustrator:

Binding: Hardcover

Published by: Oxford University Press: , 1997

Edition:

ISBN: 9780195108095 | 0195108094

512 pages.

Book Condition: Very Good

Pickup currently unavailable at Book Express Warehouse

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 35 Nathan Terrace, Shannon NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. There may be some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 35 Nathan Terrace, Shannon, 4821, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unread.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 35 Nathan Terrace, Shannon, New Zealand 4821.

If your return is for a quality or incorrect item, the cost of return will be on us, and will refund your cost. If it is for a change of mind, the return will be at your cost.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalised items), and personal care goods (such as beauty products). Although we don't currently sell anything like this. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.