Financial Modeling For Equity Research: A Step-by-Step Guide to Earnings Modeling by John Moschella

This book demonstrates step-by-step how to create a financial model. The accompanying Excel files demonstrate the key concepts and can be used as templates to create an earning model for nearly any company. Readers without prior financial analysis experience will gain a fundamental understanding of exactly what modeling entails, and will learn how to create a basic form of an earnings model. Advanced readers will be introduced to more complex topics such as linking the financial statements, future period calibration, and incorporating macroeconomic variables into discounted valuation analysis through the equity risk premium and application of the capital asset pricing model. The Excel templates included with this book include: ? File 1 - Blank Model Template: Use this template to create your own earnings model. ? File 2 - Apple Inc Back of the Envelope Model: This beginner model features a basic Income Statement projection and is perfect for those who have not had prior modeling experience. ? File 3 - Apple Inc Tier 2 Earnings Model: This version of the model is more sophisticated and includes a breakdown of the company's products, which is used to project future earnings. ? File 4 - Apple Inc Tier 1 Earnings Model: The Tier 1 model is geared toward advanced analysts and includes financial statement integration, as well as a discounted cash flow valuation. ? File 5 - Equity Risk Premium (ERP) Model: Using this simple model you can quickly estimate the market ERP based on volatility, changes in interest rates, and market return expectations. You can then derive a discount rate using your ERP estimate, and the Capital Asset Pricing Model (CAPM). ? File 6 - Apple Inc Beta Calculation: This file demonstrates the calculation of beta, using an Excel-based regression. ? Files 7&8 - Regression Models: The final two files demonstrate how to run regression analysis to project inputs which could be incorporated into your earnings models. This book is well suited for... Business Students: Whether you are majoring in Finance, Accounting, Marketing, Entrepreneurship, or Management, learning the fundamentals of forecasting is critical to your academic development, and will help prepare you for a professional career. Sell-Side Equity Research Analysts: Need a fresh perspective for your models? Consider adding changes in volatility, interest rates, or corporate tax reform to your valuation approach. Or incorporate non-GAAP adjustments, and forecast the impact of new accounting standards into your models. Financial Planners and Wealth Management Professionals: Have your clients been asking your opinion of a stock in the headlines? This book will teach you how to build a model for nearly any company, allowing you to deliver comprehensive analysis to your clients. Buy-Side Analysts: Want a consensus-based model to compare to that of each analyst? This book demonstrates how to create one, and how to use it to perform quick reviews of consensus estimates, management's guidance, and run powerful scenario analysis ahead of an earnings release. Investor Relations Professionals: Gain valuable insight into how the analysts covering your company are modeling your results, and use this knowledge to predict what the analysts will ask on the conference calls. Private Equity/Venture Capital Analysts: Trying to value a new investment with unpredictable cash flows? Use this book as a guide to build a dynamic model, and incorporate various inputs to create upside/downside scenarios. ...as well as anyone else interested in learning how to use fundamental analysis to review an equity security's future prospects. Editorial Reviews From the Author Equity research is a difficult field, with a steep learning curve for new associates. The hours are long, clients are demanding, and modeling errors are unacceptable. When I first joined the semiconductor research team at a New York-based investment bank I struggled with the workload. Between the 100 hour workweeks during earnings season, getting up-to-speed with the fundamentals of a highly technical industry, and studying for the FINRA exams, there was no additional time to learn the basics of the day-to-day tasks, most importantly how to model a company's earnings.Most senior research analysts have little time for training, so new associates tend to teach themselves, as I did, by reverse-engineering their team's models. I wrote this book and designed the Excel templates as resources for new associates to assist in the financial modeling learning process. This book is based on my experience as a Sell-Side Research Associate, with input from the quantitative methods I used as a Risk Analyst, and a unique consideration of financial reporting from my time as a Public Accountant. The methods covered are primarily geared toward sell-side earnings modeling, however, many of the topics are also applicable to careers in investment banking, asset management, or any other field which requires knowledge of forecasting or valuation.Remember modeling is part science and part art. The chapters to follow describe the modeling approach I use in practice. There are many different methods, variations, and techniques you can use to forecast earnings. If you have prior modeling experience, feel free to incorporate your own spin on the steps as you work through each section. If you are new to modeling, you may find some of the concepts difficult at first, but if you follow each step you will be able to build an earnings model for nearly any company. About the Author John has more than a decade of experience analyzing companies in various capacities. After earning a BSBA in Finance, MS in Accounting and MBA from Northeastern University, he began his professional career at PricewaterhouseCoopers (PwC) in New York as an Assurance Associate in the Financial Services practice. He also participated in a rotational assignment in the Financial Service Research Institute at PwC where he studied bank mergers during the financial crisis.After PwC, John spent five years at UBS Investment Bank where he worked first as a Capital Specialist, and then as an Equity Research Associate. In his research role, he maintained earnings models for companies in the Semiconductor and Semiconductor Equipment Industries, contributed to research reports, and participated in investor conferences.John moved to General Electric Capital Corp in early 2014 as a Lead Risk Analyst where he built regression models to predict asset losses based on various macroeconomic scenarios. After the sale of the majority of GE Capital's assets, John started a consulting firm which provides capital planning support to investment banks, in addition to running Gutenberg Research.About Gutenberg ResearchGutenberg Research is a web-based, interactive earnings modeling community, which provides professional analysis based on modern portfolio theory and fundamental valuation techniques, with the mission of making earnings models available to all investors.ÂThe Gutenberg name and philosophy are inspired by the fifteenth century visionary and inventor of the printing press, Johannes Gutenberg. Gutenberg's press forever altered the state of communication and flow of information through the mass production of books, changing literacy from a luxury of an elite few, to a right of the masses. The Gutenberg Research community is building an inventory of models which all investors can access for free.

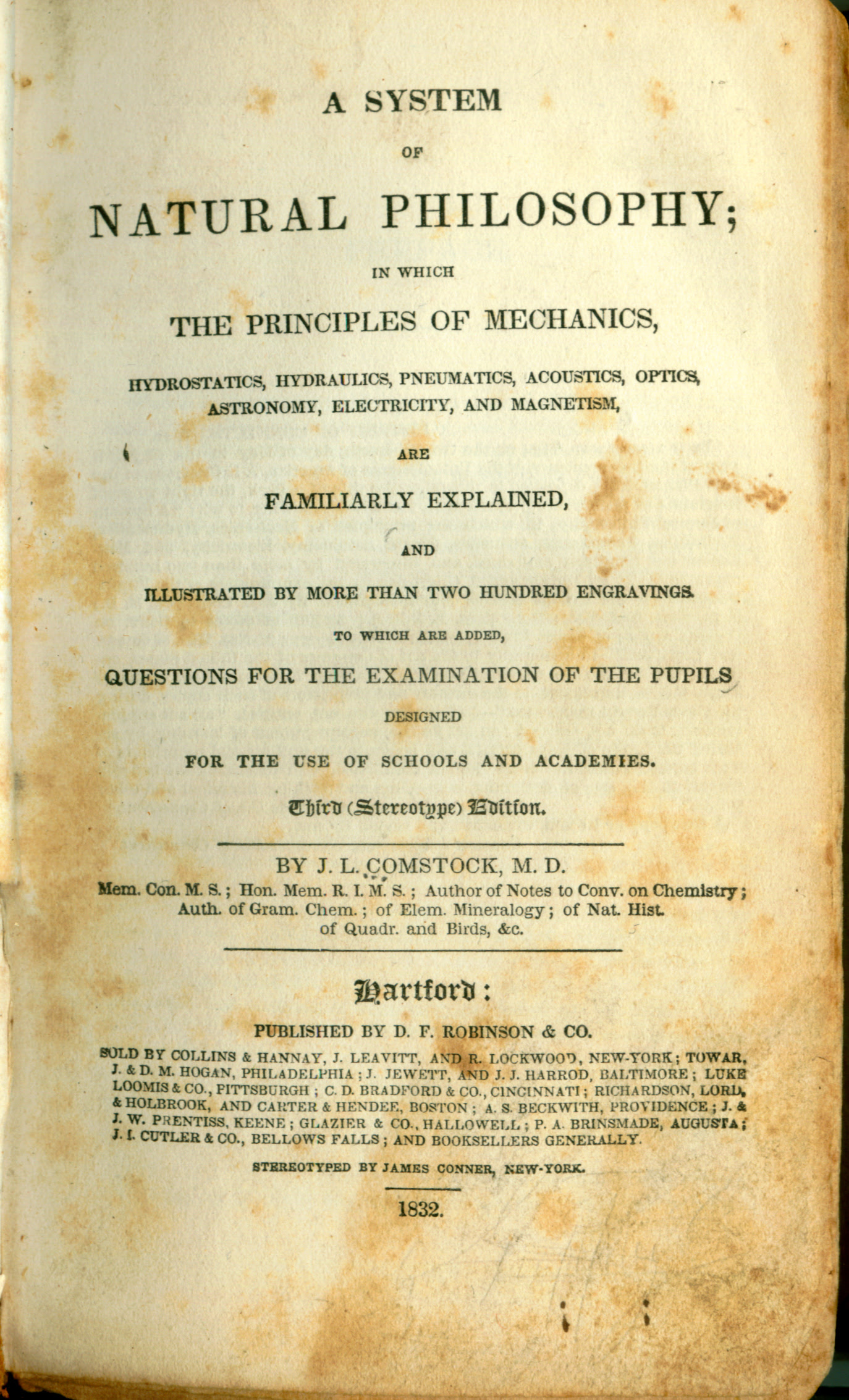

Publication Details

Title:

Author(s):

Illustrator:

Binding: Paperback

Published by: Independently published: , 2017

Edition: Second edition

ISBN: 9781549832864 | 1549832867

101 pages.

Book Condition: Very Good

Pickup currently unavailable at Book Express Warehouse

Product information

New Zealand Delivery

Shipping Options

Shipping options are shown at checkout and will vary depending on the delivery address and weight of the books.

We endeavour to ship the following day after your order is made and to have pick up orders available the same day. We ship Monday-Friday. Any orders made on a Friday afternoon will be sent the following Monday. We are unable to deliver on Saturday and Sunday.

Pick Up is Available in NZ:

Warehouse Pick Up Hours

- Monday - Friday: 9am-5pm

- 35 Nathan Terrace, Shannon NZ

Please make sure we have confirmed your order is ready for pickup and bring your confirmation email with you.

Rates

-

New Zealand Standard Shipping - $6.00

- New Zealand Standard Rural Shipping - $10.00

- Free Nationwide Standard Shipping on all Orders $75+

Please allow up to 5 working days for your order to arrive within New Zealand before contacting us about a late delivery. We use NZ Post and the tracking details will be emailed to you as soon as they become available. There may be some courier delays that are out of our control.

International Delivery

We currently ship to Australia and a range of international locations including: Belgium, Canada, China, Switzerland, Czechia, Germany, Denmark, Spain, Finland, France, United Kingdom, United States, Hong Kong SAR, Thailand, Philippines, Ireland, Israel, Italy, Japan, South Korea, Malaysia, Netherlands, Norway, Poland, Portugal, Sweden & Singapore. If your country is not listed, we may not be able to ship to you, or may only offer a quoting shipping option, please contact us if you are unsure.

International orders normally arrive within 2-4 weeks of shipping. Please note that these orders need to pass through the customs office in your country before it will be released for final delivery, which can occasionally cause additional delays. Once an order leaves our warehouse, carrier shipping delays may occur due to factors outside our control. We, unfortunately, can’t control how quickly an order arrives once it has left our warehouse. Contacting the carrier is the best way to get more insight into your package’s location and estimated delivery date.

- Global Standard 1 Book Rate: $37 + $10 for every extra book up to 20kg

- Australia Standard 1 Book Rate: $14 + $4 for every extra book

Any parcels with a combined weight of over 20kg will not process automatically on the website and you will need to contact us for a quote.

Payment Options

On checkout you can either opt to pay by credit card (Visa, Mastercard or American Express), Google Pay, Apple Pay, Shop Pay & Union Pay. Paypal, Afterpay and Bank Deposit.

Transactions are processed immediately and in most cases your order will be shipped the next working day. We do not deliver weekends sorry.

If you do need to contact us about an order please do so here.

You can also check your order by logging in.

Contact Details

- Trade Name: Book Express Ltd

- Phone Number: (+64) 22 852 6879

- Email: sales@bookexpress.co.nz

- Address: 35 Nathan Terrace, Shannon, 4821, New Zealand.

- GST Number: 103320957 - We are registered for GST in New Zealand

- NZBN: 9429031911290

We have a 30-day return policy, which means you have 30 days after receiving your item to request a return.

To be eligible for a return, your item must be in the same condition that you received it, unworn or unread.

To start a return, you can contact us at sales@bookexpress.co.nz. Please note that returns will need to be sent to the following address: 35 Nathan Terrace, Shannon, New Zealand 4821.

If your return is for a quality or incorrect item, the cost of return will be on us, and will refund your cost. If it is for a change of mind, the return will be at your cost.

You can always contact us for any return question at sales@bookexpress.co.nz.

Damages and issues

Please inspect your order upon reception and contact us immediately if the item is defective, damaged or if you receive the wrong item, so that we can evaluate the issue and make it right.

Exceptions / non-returnable items

Certain types of items cannot be returned, like perishable goods (such as food, flowers, or plants), custom products (such as special orders or personalised items), and personal care goods (such as beauty products). Although we don't currently sell anything like this. Please get in touch if you have questions or concerns about your specific item.

Unfortunately, we cannot accept returns on gift cards.

Exchanges

The fastest way to ensure you get what you want is to return the item you have, and once the return is accepted, make a separate purchase for the new item.

European Union 14 day cooling off period

Notwithstanding the above, if the merchandise is being shipped into the European Union, you have the right to cancel or return your order within 14 days, for any reason and without a justification. As above, your item must be in the same condition that you received it, unworn or unused, with tags, and in its original packaging. You’ll also need the receipt or proof of purchase.

Refunds

We will notify you once we’ve received and inspected your return, and let you know if the refund was approved or not. If approved, you’ll be automatically refunded on your original payment method within 10 business days. Please remember it can take some time for your bank or credit card company to process and post the refund too.

If more than 15 business days have passed since we’ve approved your return, please contact us at sales@bookexpress.co.nz.